Car Insurance for Teens & New Drivers

How to Get Auto Insurance for Teen Drivers

Finding the right car insurance for teenagers is crucial for both peace of mind and financial protection. While auto insurance for teens can be pricier due to their lack of driving experience, GEICO is here to help you find the right car insurance rates for your new driver.

As parents and young drivers navigate the roads together, understanding the unique considerations and options available can make all the difference. From exploring coverage tailored to inexperienced drivers to accessing resources aimed at promoting safe driving habits, our insurance solutions are designed to support teens and their families every mile of the journey.

Save on Car Insurance Cost for Teens and Young Drivers

GEICO DriveEasy

DriveEasy offers discounts on car insurance premiums by monitoring safe driving habits through the GEICO mobile app. Teen drivers especially can benefit from this program, which promotes and rewards safe driving behaviors.

- DriveEasy tracks the driving habits of every enrolled insured and rewards safe driving habits with a discount (all eligible drivers must enroll).

- Drivers could be eligible for a discount of up to 15% by simply enrolling in the program and monitoring their driving.

- After the monitoring period, drivers who demonstrate safe driving habits can receive a discount that exceeds 15%.

- Know your teens driving habits.

Join the 260,000+ teen drivers that have enrolled in DriveEasy already, 75% of which received a discount after renewal!

Other GEICO Discounts

Car insurance for new teen drivers can be costly due to their limited driving experience and higher accident rates. You can often save money by adding your licensed teen to your existing car insurance policy and extending your coverage to them.

Your young driver could also qualify for these money-saving discounts.*

- Good student discount: available when an eligible driver on the policy maintains a "B" average or better.

- Multi-vehicle discount: available when you insure more than one car with GEICO.

- Multi-policy discount: available when you bundle your auto policy from GEICO with other insuracne policies like homeowners, renters, motorcycle, and RV.

*Discounts available in most states.

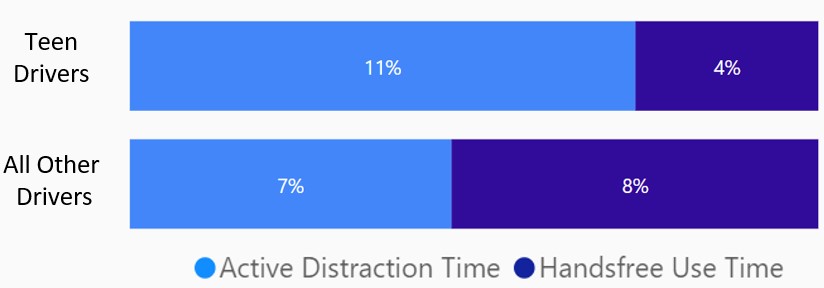

Reduce Teen Active Distracted Driving

Work with your teen to improve their safe driving skills by reducing their distracted driving time.

Encourage them to avoid active distractions, such as handheld phone use while driving.

It's best to avoid using your phone entirely while driving, but, if necessary, replace active distraction habits with handsfree alternatives like:

- Answering calls through a Bluetooth-enabled device

- Controlling music and GPS through the voice-activated assistant in your car or phone

- Utilizing steering wheel controls for music and phone call activities

- Enabling Apple CarPlay or Android Auto if available

Tips for parents of new teen drivers

- Discuss when, where, how, and who your teen can drive

- Discuss limiting the number of passengers in the car

- Establish a curfew

- Insist your teen driver (and passengers) wear seat belts at all times

- Limit teen driving during high-risk times, like Friday or Saturday nights

- Set driving-area limits

- Prohibit driving under the influence or riding with friends who are

How much is car insurance for teens and new drivers

Car insurance for teens and new drivers tends to have higher premiums because younger drivers statistically pose higher risks.

Teenage car insurance premiums are also impacted by whether they purchase a separate policy or are added to an existing one. When teens are added to existing policies as drivers, they can typically secure lower rates.

Factors that influence the cost of insuring a teen driver

When determining insurance premiums for teen drivers, GEICO considers individual factors such as age, driving record, and type of vehicle. However, we offer discounts and personalized solutions to help mitigate expenses and ensure comprehensive coverage for your teen.

Will the rate drop as my teen driver gets older?

While rates typically decrease as teen drivers gain experience and demonstrate safe driving practices, individual circumstances vary. Factors like driving record, vehicle type, and coverage choices influence rate adjustments. Maintaining a clean driving record and completing driving courses can help lower premiums over time.

How to Add a Teen Driver to your Car Insurance

For parents, it's important that your teen driver has the proper amount of car insurance coverage before they get behind the wheel. Luckily, adding them to your auto insurance policy is easy. It may also be cheaper than getting them a new policy of their own. Contact a GEICO agent when your teen gets their permit or driver's license to get a quote for a new driver on your policy. You may also add your teen driver to your existing GEICO policy at geico.com or in the GEICO mobile app.

Moving a Teen or Young Driver to Their Own Car Insurance Policy

GEICO makes it easy to move a teen or young driver to their own auto insurance policy. We can apply discounts they qualify for and give them the benefit of their experience on an existing policy. They'll also continue getting the same great customer service. We are here to help—from making a policy change, filing a claim, or even just asking us a question.

Alternatively, if you decide to add a teen driver to your policy, your existing car insurance coverage will extend to them. To ensure adequate protection for every driver’s unique circumstance, you can differentiate your coverage based on the vehicle your teen driver uses. For example, you may choose not to purchase collision or comprehensive coverage on an older vehicle to reduce costs, while electing to carry those coverages on a new vehicle. With GEICO, you can confidently insure multiple drivers with the coverages that fit your unique needs.

Choosing the Right Car Insurance for Teens and New Drivers

Consider the type of car: Young drivers are inexperienced and the risk of injury or damage increases dramatically when novice drivers are in control of high-performance cars. However, insurance costs are lower on more conventional vehicles.

Review your deductible: This applies to all drivers, not just young teen drivers. Increasing deductibles, which results in sharing a greater portion of any comprehensive or collision loss, can reduce auto insurance premiums. Be mindful to select a deductible that you’re comfortable paying should a loss occur.

Drop some coverage: Consider dropping collision and comprehensive coverages for an older car that your teenage driver might be using. These coverages generally compensate up to a vehicle’s actual cash value after a loss, so the added premium may not be worth the potential payout.

Educating Parents and Teen Drivers

Experience helps teen drivers stay safe on the road. Experience also helps share a responsible attitude about driving. Responsible driving could help keep your car insurance rates low. We've compiled some helpful resources to get teens and parents started.

Safety Resources for Teen Drivers

- Teen Drivers channel on You Tube: Subscribe for safety videos for and about teens.

- Teen Driving Resources: Find brochures, presentations, and a parent-teen contract for educating teens and parents on the challenges facing young drivers.

- IIHS Teen Driver Info: The Insurance Institute for Highway Safety has information and statistics about graduated licenses, safe cars, and more.

- Are you a distracted driver?: From cell phones to eating your lunch, distracted driving is common and dangerous. Think you know how to drive and multi-task? Read on for tips that might surprise you.

- Parents' Role in Teen Safety: Tips to help parents shape a responsible driving attitude for their teen driver.

- Reducing the Cost of a Teen Driver: Recommendations to help parents watch costs with a new teen driver.

Car Insurance and Accidents

- Top 10 ways to prevent an accident: A quick list of tips that might seem obvious, but are really important to helping you avoid an accident.

- Auto insurance basics: Insurance can be a complicated thing. Learn what it is, why you need it, and ways to save money as a new driver.

- Branching out on your own: Coming off your parent's GEICO policy? Learn more about the advantages of staying with GEICO for your own policy.

Teen Car insurance FAQ

-

What types of car insurance coverages are best for teens?Although many states only require liability coverage, it's a good idea to add collision, comprehensive, and uninsured/underinsured motorist coverage to your teen's car insurance. Together, these coverages will ensure your teen driver is protected against various types of unexpected losses, from accidents to windshield damage and more.

-

Do I have to add my teen driver to my car insurance policy?Yes, in most cases, you must add your teen to your policy if they live in your household. Failing to do so could result in a denied claim if they're involved in an accident. Some insurers require notification as soon as a teen gets their permit, while others wait until they're licensed. Check with your insurance provider for specific requirements.

-

Will my teen driver's car insurance rate decrease when they get older?Car insurance rates typically decrease as teens age and gain driving experience. Discounts may also apply as they reach milestones, like driving 5 years accident free or completing safe driving courses. Consistently demonstrating responsible driving behavior can also help reduce premiums over time.

-

How much does it cost to add a teen driver to my car insurance?How much it costs to add a teen driver to your car insurance depends on factors like their age, location, and vehicle type. Keep in mind that rates are generally higher for teen drivers due to their lack of experience and increased risk of accidents. However, some providers offer car insurance discounts for good grades, safe driving courses, or vehicles with safety features, which can help reduce the additional cost.

-

What is the youngest age to get car insurance?Your teenager typically cannot get their own car insurance policy until they turn 18. However, they can be added to your policy as a driver when they get their driver's license. Some states and insurers allow teens as young as 15 to be added to policies when they receive their learner's permit. Check with your car insurance provider to determine when to add your teen to your policy.

Disclaimer:

GEICO invites driver's education, law enforcement, civic and community organizations that provide education on highway and traffic safety to download a supply of our materials at no cost. For a complete list of brochures and presentations, please visit our Auto Safety Library.

GEICO contracts with various membership entities and other organizations, but these entities do not underwrite the offered insurance products.

Some discounts, coverages, payment plans, and features are not available in all states or all GEICO companies. Discount amount varies in some states. One group discount applicable per policy. Coverage is individual. In New York a premium reduction may be available. GEICO may not be involved in a formal relationship with each organization; however, you still may qualify for a special discount based on your membership, employment, or affiliation with these organizations.

*DriveEasy is an optional program that is not available in all states and situations. Premium rates generally will vary based on participation in the program and the driving habits logged by the app. For more information, see the GEICO Mobile User Agreement and FAQs.